Buy an HDB Flat

Buying an HDB Flat

ON THIS PAGE

Planning Your Flat Purchase

Find out your eligibility to buy an HDB flat

The eligibility criteria to buy an HDB flat depends on your citizenship, age, income ceiling as well as with whom you are buying the flat.

Another criteria to note is that you (and whoever listed in your application) do not own other property overseas or locally, and have not disposed of any within the last 30 months.

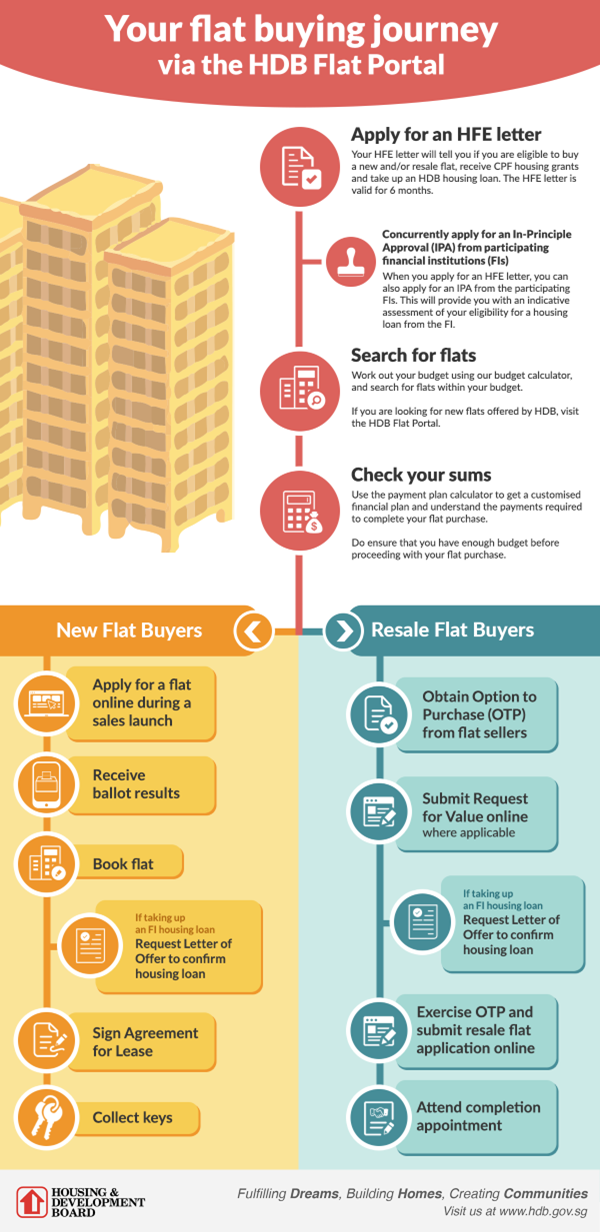

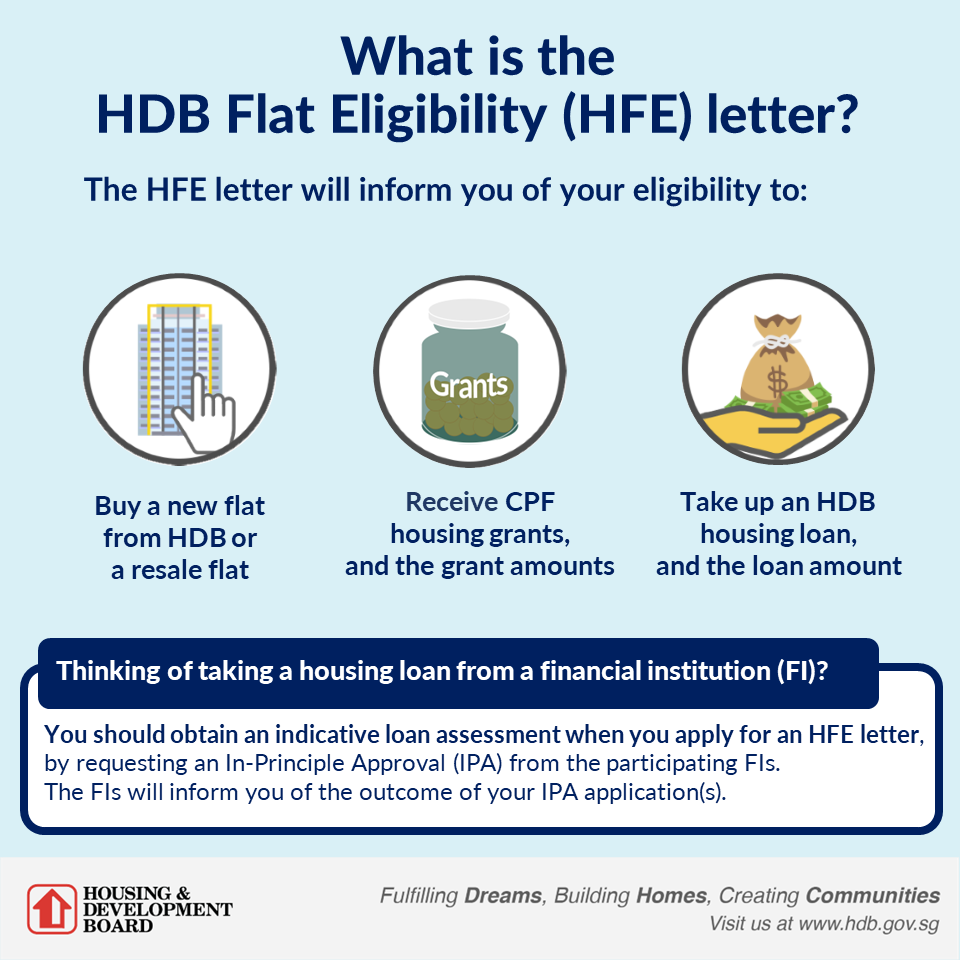

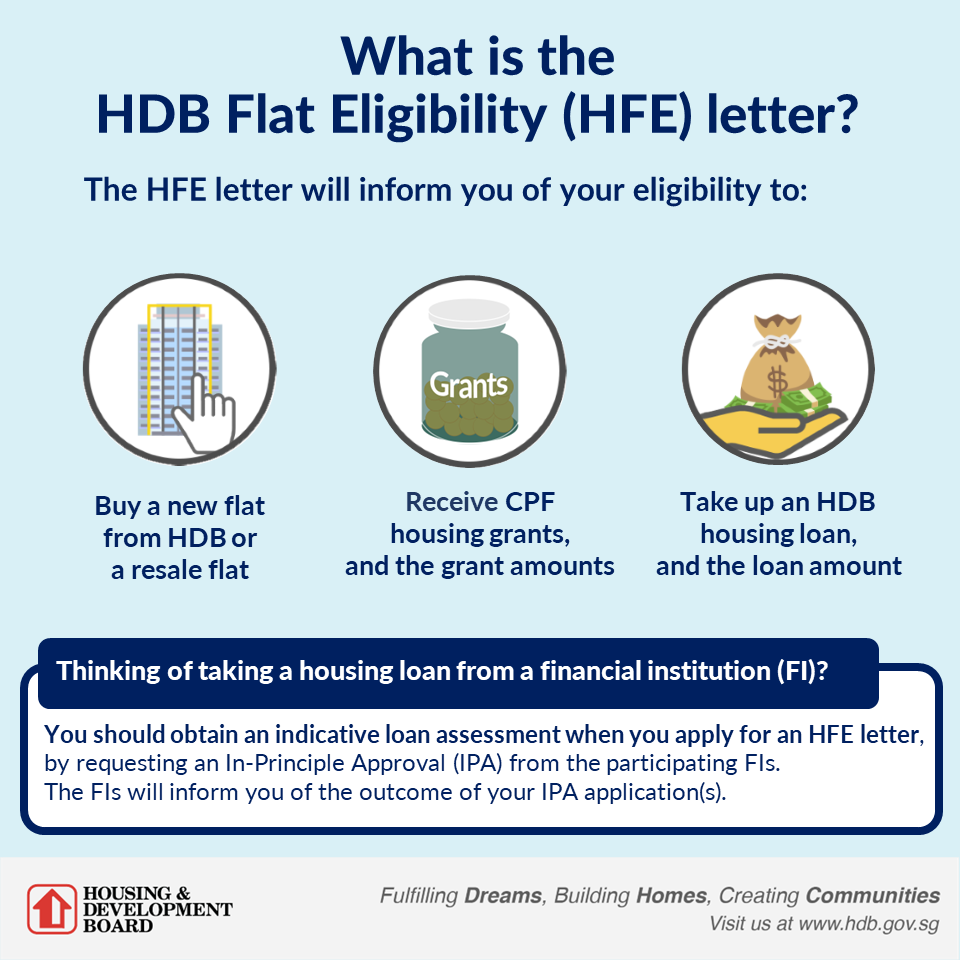

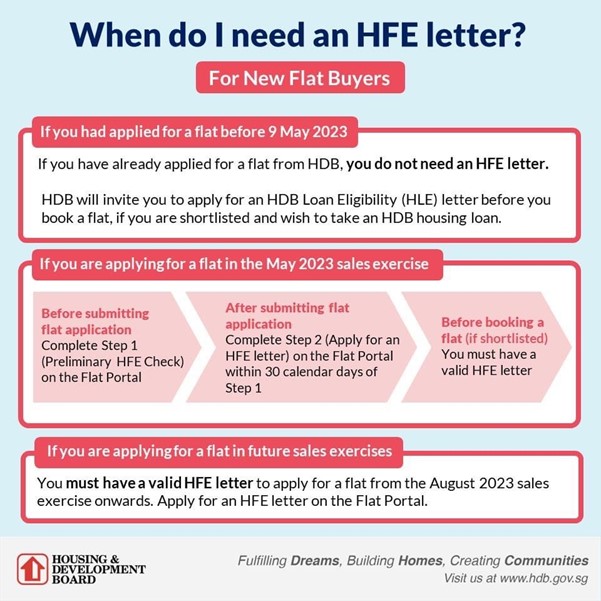

From 9 May 2023, you must have a valid HDB Flat Eligibility (HFE) letter when you are buying an HDB flat:

- Apply for a flat in HDB's sales launches or open booking of flats; or

- Obtain an Option To Purchase (OTP) from a flat seller as well as when submitting a resale application to HDB.

The HFE letter will provide you with a holistic understanding of your housing and financing options and help you plan your flat budget before you embark on your home buying journey. If you are a second-timer, it will also provide information on the resale levy/ premium that you will have to pay if you purchase another subsidised flat from HDB.

See also: Overview of Eligibility Conditions and Application for an HDB Flat Eligibility (HFE) letter

Plan Your Finances

It is important for you to work out your flat budget before committing to a flat purchase. Use the budget or payment plan calculator to work out a customised financial plan.

Check your eligibility for an HDB housing loan as part of the process when you apply for a HDB Flat Eligibility (HFE) Letter.

You may also finance your flat purchase with a housing loan from a financial institution (FI) that is regulated by the Monetary Authority of Singapore (MAS) by finding out more here.

You should consider and compare the different FI loan packages offered.

If you intend to take an FI loan, you may request for an In-Principle Approval (IPA) and Letter of Offer (LO) from the participating FIs through the integrated loan application service on the HDB Flat Portal.

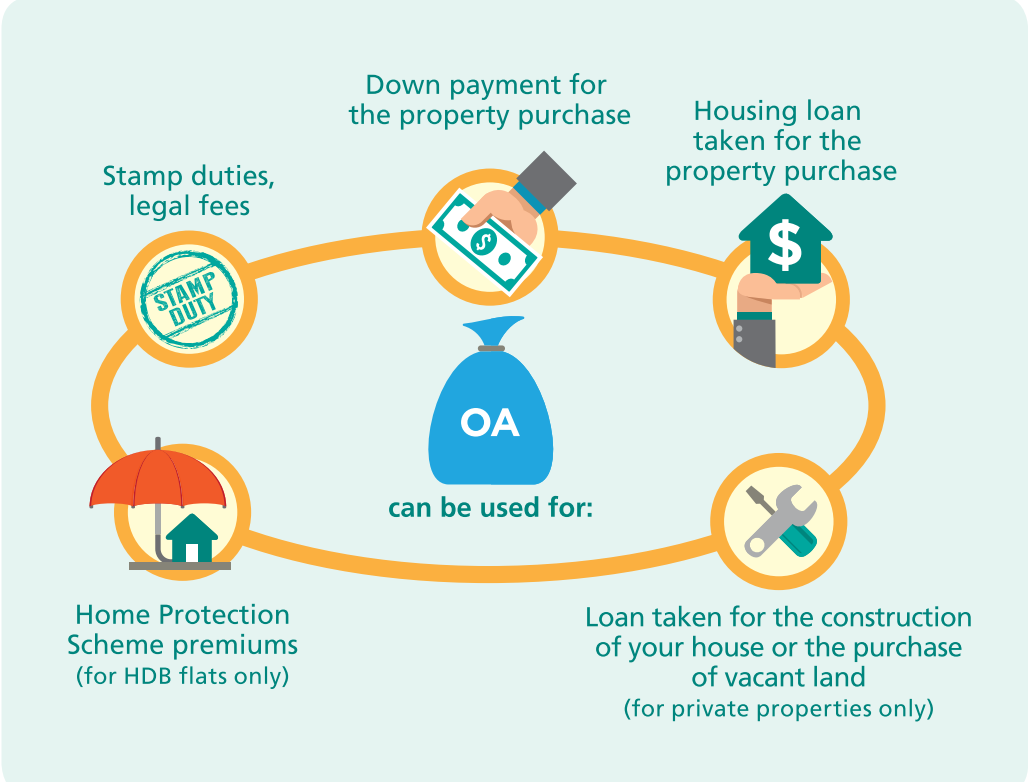

You can use your CPF Ordinary Account (OA) savings to pay for your new or resale HDB flats. Click here to calculate how much CPF you can use to buy a HDB Flat.

If you are a first-time homebuyer, you should also consider the various payments to make for an HDB housing loan, should you require one.

Check your affordability and minimise the housing loan amount and repayment period to save interest costs.

See also: ABCs of financial planning and tools

You can consider the Contra Payment Facility if you are buying an HDB flat and currently own another HDB flat.

This can help you to:

- Reduce the cash outlay needed for your flat

- Reduce the housing loan amount needed and the subsequent monthly repayments (without incurring interest)

- Collect the keys to your flat while selling your existing flat

First-time buyers may receive an Enhanced CPF Housing Grant of up to $80,000 when buying a new flat from HDB.

If they buy a resale flat, they can get up to $160,000 in housing grants. This comprises of the CPF Housing Grant of up to $50,000, Enhanced CPF Housing Grant of up to $80,000, and Proximity Housing Grant of up to $30,000.

Note: The amount of grants obtained has to be returned to your CPF Ordinary Account with accrued interest when you sell your flat later. It is not the same as a subsidy where the prices are 'discounted'.

Applying for a Flat From HDB

Before You Apply

Before you participate in a sales launch or open booking of flats, you need to obtain a HDB Flat Eligibility (HFE) letter to check your eligibility to buy a new flat and whether you can obtain a HDB housing loan and the CPF housing grant

See also: Overview of Eligibility Conditions

There are various types of flats that are built to suit a variety of needs:

- 2-room Flexi for small families, singles and elderly

- 3-room for cosy and compact home

- 4-room for a comfortable living space

- 5-room for larger households

See also: HDB flat types and its specifications

To buy a new flat from HDB, you need to apply during a sales launch. Check upcoming HDB sales launches and stay updated with email updates

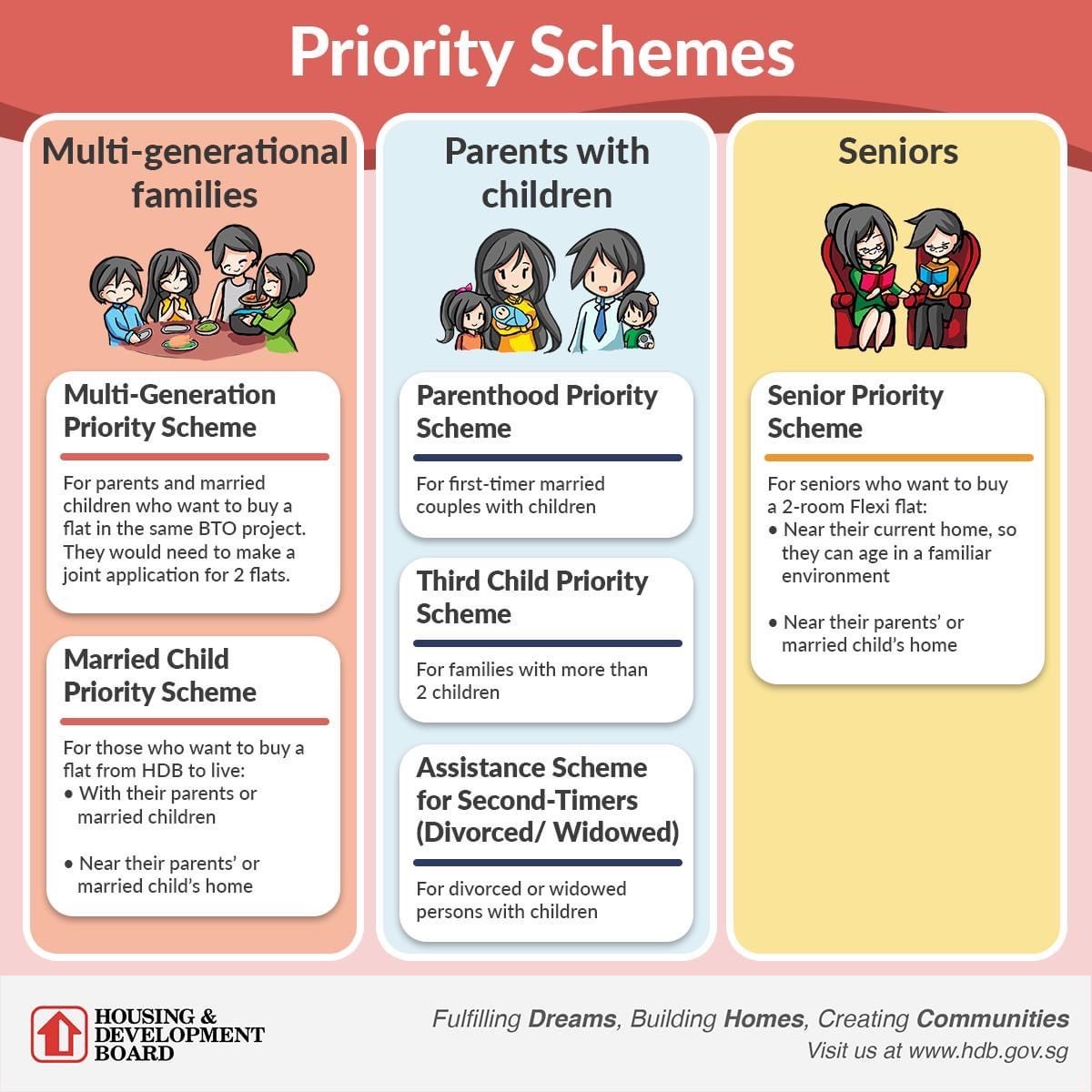

By applying through HDB Priority Schemes, you could improve your chances of getting a balloted number to book an HDB flat. However, do note that you can get priority for only up to 2 schemes.

What to Expect

You may find more details here about the timeline of buying a flat.

Steps Involved

You may apply for a flat in the following purchase mode(s):

As an applicant, you can check for updates regarding your flat application and whether a queue number has been balloted to you.

If you have been shortlisted, you will be notified and invited to an HDB flat selection appointment within two weeks from the release of your ballot results.

At this appointment, you will be required to pay a booking fee via NETS.

The booking fees range from $500 to $2000 depending on the type of flat you choose.

You (and all persons listed in the application) will also need to bring along original copies of these documents:

- Identity cards of all persons listed in the application

- Letter of Offer from the financial institution if you are taking a housing loan from a financial institution

- Latest CPF statement(s) if you are currently employed with CPF Board

- Power of Attorney (if you are authorising someone to represent you)

- The person representing you must bring one certified true copy by the solicitors and two photocopies of the signed Power of Attorney

You will also need to log into your Singpass during your appointment if you intend to use CPF savings to pay for your downpayment (usually 10% of the flat price). You can consider if you can split your downpayment into 2 instalments using the Staggered Downpayment Scheme.

You will be invited by HDB to collect your keys when your project is ready. Check your HDB appointment online to know when you can collect your keys.

Do bring along original copies of these documents for your appointment:

- Identity cards of all persons listed in the application

- Certificate of insurance

- You must buy fire insurance from HDB's appointed insurer, FWD Singapore Pte Ltd (FWD), if you are taking an HDB housing loan.

- Latest CPF statement(s) if you are currently employed with CPF Board

- Power of Attorney (if you are authorising someone to represent you)

- The person representing you must bring one certified true copy by the solicitors and two photocopies of the signed Power of Attorney

- Signed GIRO form if you are paying monthly loan instalments partially or fully by cash

You will also be required to log into your Singpass during your appointment if you intend to use CPF savings to pay for your monthly loan instalments.

Buying an HDB Resale Flat

Eligibility Criteria

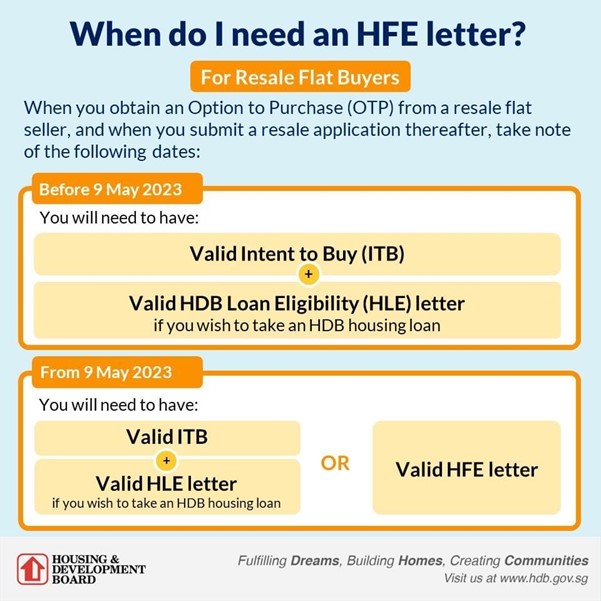

Before you obtain an Option to Purchase (OTP) from a flat seller, as well as when you submit a resale application to HDB, you need a valid HDB Flat Eligibility (HFE) Letter. The HFE letter will check your eligibility to buy a resale flat and whether you can obtain an HDB housing loan and the CPF housing grant.

See also: Overview of Eligibility Conditions

What to Expect

You may find more details here about the timeline of buying a resale flat.

You may manage the flat purchase on your own or engage an estate agent to help you.

Steps Involved

To start, you need to first apply for a HDB Flat Eligibility (HFE) letter to know if you can:

- Buy a HDB resale flat

- Apply for which CPF housing grants

- Apply for HDB housing loan (if you intend to loan from HDB)

When evaluating options,

- Check details of the flat options such as past resale transactions, Ethnic Integration Policy quotas, Singapore/PR quotas

- Check other HDB resale statistics such as resale price index for overall HDB resale pricing trends.

To enter into a OTP contract, you would be required to go through the following steps after agreeing on the selling price with the seller.

- Seller grants OTP to you with the agreed amount of Option Fee (between $1 to $1,000)

- Review purchase during Option Period of 21 days

- Exercise OTP to proceed with the purchase

You can also choose to let the OTP expire if you decide not to purchase.

You may refer to this guide to find more details regarding the OTP process

During your application for a HFE letter, you would be informed of your eligibility for buying a HDB resale flat as well as the amount of HDB housing loan that you are eligible for, should you require one.

You can also get a housing loan from a financial institution (FI).

You and the seller (or the salesperson) can proceed to submit the resale application after you have exercised the Option to Purchase (OTP).

Note that either you or the seller can be the first to submit, but the other party must submit their portion within 7 calendar days.

You will be invited by HDB to endorse resale documents and pay the resale fees online before approving the transaction.

It could take about 8 weeks from HDB's acknowledgement of the resale application to the final step of completing the resale transaction.

Check your resale application status or get notified via SMS once HDB approves.

Once HDB has scheduled your appointment, you will also receive SMS notification on your appointment with HDB.

This is the only resale appointment at HDB you and the seller need to attend. At this appointment, you (and the seller) will:

- Sign the mortgage document/ agreement (if you are taking an HDB housing loan)

- Acknowledge the receipt of the keys to the flat

- Agree on the payment arrangement of the outstanding property tax with the seller

- Indicate how you will pay the first month service/ conservancy charges

You will become the flat owner upon the resale completion and need to pay for various payments such as housing loan, monthly service/ conservancy charges, annual property tax, etc.

See also: Financial Obligations as HDB owner

You may also be interested in:

This page will be updated as additional schemes and measures are introduced.

Please contact the respective government agencies if you have any questions about the listings on this page.

Last updated: 19 May 2023

Give us your feedback

Share with us your suggestions with us here.