Get Government Benefits

Disclaimer: This page does not include the latest schemes announced at Budget 2021.

I Want to Get Government Benefits

ON THIS PAGE

What Government Benefits Are

If you are looking for some help, there are a wide range of support schemes and grants available across the government to help you in times of difficulty or when you support government initiatives.

Benefits For Families

What You Can Get

For each Singaporean child born, you will receive cash of $6,000 for your 1st and 2nd child, and subsequently $8,000 for each of your 3rd and 4th child. This cash gift is disbursed over 4 installments in the first 18 months of the birth of your child.

To check if the child is eligible for Baby Bonus cash gift, Baby Support Grant and/or CDA benefits, you can use this Eligibility Checker Tool.

All Singaporean babies will qualify for the MediSave Grant for Newborns of $4,000. A CPF MediSave account will be opened for each newborn automatically, with the grant credited.

This is to support your child in his or her medical expenses such as MediShield Life premiums, vaccinations, hospitalisation, and approved outpatient treatments.

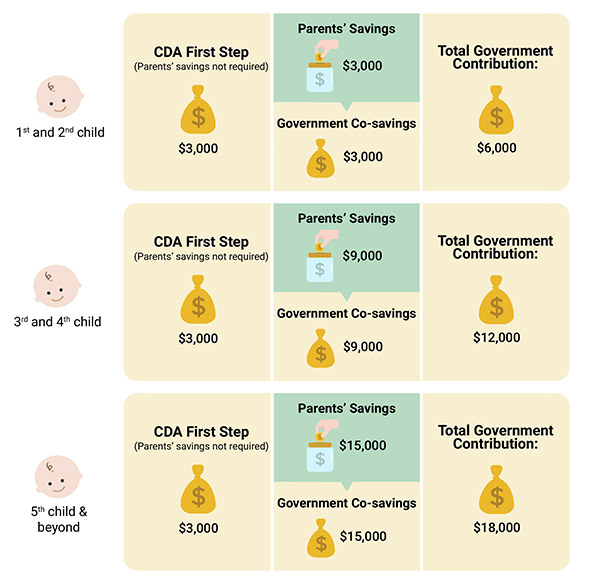

The Baby Bonus Child Development Account (CDA) is a special savings account:

- Your child (as a Singapore Citizen) will receive $3,000 upon the opening of the CDA First Step with any of the three banks (DBS, OCBC or UOB).

- You can continue to save beyond this initial balance and enjoy dollar-for-dollar matching, up to the Government contribution cap in the CDA.

The CDA can be used for your child's medical and education needs at the List of Approved Institutions. Any unused balances from this account will be transferred to your child’s Post-Secondary Education Account (PSEA) when your child turns 13.

All Singaporean students will have an Edusave account where they receive government top-ups for educational use (i.e not a bank account where you can contribute to)

These contributions are made by the government in the following ways:

- Government Annual Top-ups: Every February, between age 6 and 16

- One-off Budget Top-ups: Amount depends on the Annual Value (AV) of your home

- Edusave Awards and Scholarships - Students who have made significant achievements in school academically and non-academically are awarded with Edusave top-ups to their accounts.

Post Secondary Edusave Account (PSEA) is an account that is set up for every Singaporean child when they turn 13.

This account consists of any unused funds from your child's Edusave and CDA account. The PSEA balance earns an interest of 2.5% per annum.

When your child reach the age of 30, any remaining funds your child have will be transferred to your CPF Ordinary Account (OA) which gives a higher interest rate of up to 3.5% and also can be used for his or her future needs (e.g. housing, education and healthcare).

Pro-Family Leave Schemes

The Pro-Family Leave Schemes are in place to encourage a family-friendly culture in our workforce.

Government-Paid Maternity Leave (GPML): If you are a working mother, you can enjoy maternity leave under the GPML scheme. This will help provide sufficient time to recover from childbirth and care for newborns.

Benefits of GPML:

However, if your employment contract ended before your childbirth, you will be entitled to Government-Paid Maternity Benefit (GPMB)

Government-Paid Paternity Leave (GPPL): Working fathers can also enjoy paternity leave to allow them to have a more active role at home upon the arrival of their baby.

Benefits of GPPL:

Government-Paid Shared Parental Leave (SPL): As a working mother, you can opt to share part of your 4-month maternity leave or adoption leave with your husband under the SPL scheme.

Government-Paid Child Care Leave (GPCL):

- If your youngest child is below 7 years old, you and your spouse can each enjoy 6 days of paid child care leave over a 12-month period based on a mutual agreement with your employer.

Extended Child Care Leave (ECL):

- If your youngest child is between 7 and 12 years old, you and your spouse can each enjoy 2 days of paid child care leave over a 12-month period as agreed upon with your employer.

Adoption Leave: Adoptive working parents (including self-employed) can enjoy adoption leave benefits as well.

For instructions on applying for leave or claiming reimbursement, you can use this online demo as a guide.

Use this Government Paid Leave calculator to calculate how much you can get.

Getting Tax Reliefs

You could use these tax reliefs to reduce your tax bill each year if you are married. Some of these tax reliefs include:

- Spouse/Handicapped Spouse Relief

- NSMan Wife Relief

- Foreign Maid Levy (FML) Relief

You could use these tax reliefs to reduce your tax bill each year if you are a parent:

Raising a child can be expensive. You can claim for tax rebates from the government as working parents under the Parenthood Tax Rebate (PTR) and Working Mother's Child Relief.

This benefit is available to adoptive parents as well.

Any unutilised amount can also be transferred online from your account to your spouse's account:

- Log in to MyTax Portal to view your PTR balance and transfer your PTR balance to your spouse.

To qualify for PTR, you must be a Singapore tax resident who is married, divorced or widowed in the Year of Tax Assessment.

You can use the PTR Eligibility Tool to check what you can get.

See also: FAQs on transferring PTR online

Benefits For Employees and Self-Employed

Financial Aid for Working Adults

You may be able to get some financial aid especially if you are unemployed, on low income, or unable to work. See this guideon the various schemes available for employees and self-employed to get some financial support.

Leave Scheme for Employees

If you are an employee working under a contract of service and have worked for at least 3 months with your employer, you are entitled to annual leave as per the terms in your contract.

As an employee, you are entitled to paid sick and hospitalisation leave after at least 3 months of current employment and have informed your employer of your absence within 48 hours.

The number of days depends on your years of service - up to 14 days of outpatient sick leave and 60 days of paid hospitalisation leave (inclusive of the 14 days paid outpatient sick leave entitlement).

To qualify, you need to be certified unfit for work by a registered medical practitioner.

Getting Tax Reliefs

You could use these tax reliefs to reduce your tax bill each year if you support these government initiatives:

(1) Improve your employability

Maximum amount you can claim: Up to $5,500 each year regardless of the number of conferences/courses and seminars attended.

Note: Any amount paid or reimbursed by your employer or any other organisation cannot be claimed.

(2) Save for retirement

CPF Cash Top-up Relief (Self/Dependents):

- Maximum amount you can claim: $15,300 (Singaporean) or $35,700 (foreigner).

Supplementary Retirement Scheme (SRS) Relief:

- Maximum amount you can claim: $14,000 (maximum $7,000 for self, and maximum $7,000 for family members).

CPF Relief (Medisave Top-ups):

- Maximum amount you can claim: Depends on your Medisave balance.

- You can also top up your Medisave up to the Basic Healthcare Sum (currently $54,500) for future medical expenses and health insurance premiums.

You may be able to claim tax deductions of 2.5 or 3 times the amount of donations made from 2014 to 2021. You may find out more about the different types of donations and their respective tax deductibility.

Check What You Can Get

You can claim Tax Reliefs if all the following apply:

- You are a Singapore Citizen

- You are married or legally separated

- You meet the qualifying conditions for the specific tax relief

You can use the IRAS Personal Relief Eligibility tool to evaluate whether you would benefit from tax relief on your voluntary CPF contributions and make an informed decision.

Tip: Some of these are automatically calculated when you file your income tax

Use this calculator to calculate the number of annual leave days you can get.

How to File Tax Relief Claims

During eFiling, you can submit your claim if you need to make a revision to your claim:

- Log in to MyTax Portal

- Go to “Individuals” > “File Income Tax Return”

- Select “Edit My Tax Form”

- Go to “4. Deductions, Reliefs and Parenthood Tax Rebate”

- Go to the Tax Relief that you want to claim

- Click “Update” and enter your claim

Click here for information on the eFiling due date

You may re-file within 14 days of your previous submission or before the tax season ends.

Click here to find more information on upcoming tax due dates - including all your income details and expenses, donations and relief claims where applicable.

Do note that you can only re-file once.

You may also file an objection using the “Object to Assessment” e-Service found at myTax Portal within 30 days from your tax assessment.

You may also be interested in:

This page will be updated as additional schemes and measures are introduced.

Please contact the respective government agencies if you have any questions about the listings on this page.

Last updated: 4 January 2021

Give us your feedback

Share with us your suggestions with us here.