Manage Healthcare Costs

Managing Healthcare Costs

ON THIS PAGE

What You Can Get (As a Singapore Citizen or PR)

MediShield Life

MediShield Life is a health insurance scheme that provides all Singapore Citizens and Permanenet Residents with universal and lifelong protection against large healthcare bills, regardless of your age or health conditions.

MediShield Life helps you pay for large hospitalisation bills and selected costly outpatient treatments, such as dialysis and chemotherapy for cancer.

To keep premiums affordable, MediShield Life benefits are sized based on subsidised bills in public hospitals. If you seek unsubsidised treatment in public hospitals or private hospitals, you will also be able to claim from MediShield Life. However, as unsubsidised bills are much higher, MediShield Life will cover a smaller proportion of the bill.

Learn more about the benefits under MediShield Life here.

All Singapore Citizens (SCs) and Permanent Residents (PRs) are automatically covered from birth, or when you attain SC/PR status. There is no need to apply for MediShield Life coverage.

You can check your personalized MediShield Life premiums here.

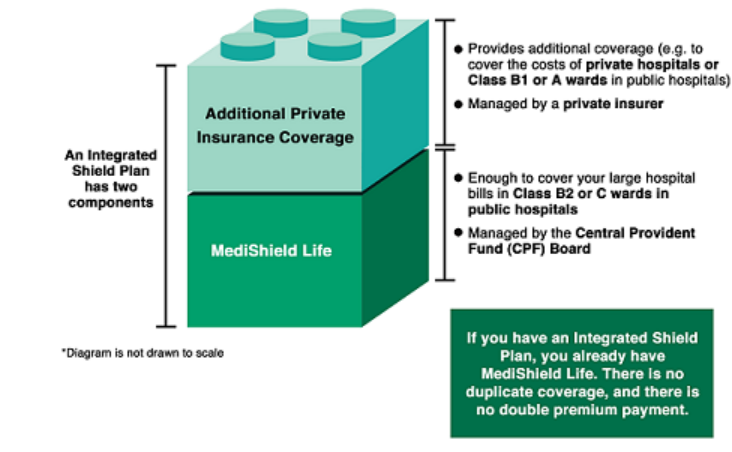

Integrated Shield Plan(IP)

In the majority of hospitalisation bills, you are unlikely to get additional payouts from your Integrated Shield Plan (IP) if you stay in B2/C wards in public hospitals.

All Singapore Citizens and Permanent Residents are covered under MediShield Life no matter how long you live, regardless of age or health condition. MediShield Life helps to pay for large hospital bills and selected costly outpatient treatments such as dialysis and chemotherapy for cancer. It is sized for subsidised treatment in B2/C wards of the public hospitals

You do not need an Integrated Shield Plan (IP) if you plan to stay in B2/C wards in public hospitals which are heavily subsidised. In fact, majority of Singaporeans, even those who had bought IP, chose to stay in B2/C wards.

If you buy an IP but choose to stay in B2/C wards in public hospitals, you might want to reconsider whether you should pay for additional private insurance

However, if you are firm in choosing B1/A wards in public hospitals or seeking treatment at private hospitals, you can consider getting an IP that matches your ward preference. If so, you should be prepared to pay additional premiums for the additional coverage.

Buying and maintaining an Integrated Shield Plan (IP) is a significant lifetime financial commitment. The degree of protection you need evolves and changes with your circumstances and age. As you reach your retirement years, your earning power is likely to reduce while your premiums will rise sharply and your priorities may shift. Depending on your hospital/ward preferences, you may not want to pay additional premiums for an IP. You should consider the following carefully:

- Are you likely to choose to seek treatment or be hospitalised at a public or private hospital?

- If you intend to go to a public hospital, will you choose a B2/C ward (six to eight beds) or Standard B1 ward (four beds) or A ward (single ward), taking into account affordability?

- If you intend to stay in B2/C wards, you need not buy an IP. This is because MediShield Life is generally sufficient as payouts are pegged to B2/C wards after government subsidies. The deductible and co-insurance can be paid via MediSave, as well as any remaining co-payment subject to the MediSave withdrawal limits.

- If you prefer to go to a private hospital, assess your means and ability to pay the additional premiums throughout your lifetime. Your annual premiums will increase sharply with age, which means that your premiums will be much higher in your retirement years. Based on the median premiums for each IP plan type, you can potentially save a significant sum.

You may also refer to the checklist when reviewing your IP coverage.

Did you know? Your private insurance premiums could be ~5 times of your MediShield Life premiums for someone in their 70/80s.

There is a range of IPs run by various major insurance companies in Singapore. They are authorised to act as your single point of contact. They will collect premium payments and disburse your claims for the MediShield Life component in your IP.

MediSave (and Flexi-MediSave for Seniors)

MediSave is your personal healthcare savings account. When you are working, you save between 8% to 10.5% (depending on your age) of your monthly salary in your MediSave Account. This helps you set aside part of your income for your healthcare expenses, especially those incurred during your retirement years.

You can use your MediSave to pay for your personal/ approved dependants*:

*Note: Approved dependants are your spouse, children, parents, grandparents and siblings. They can be of any nationality except for your grandparents and siblings who must be Singapore Citizens or Permanent Residents.

- Hospitalisation, day surgery and certain costly outpatient expenses, as well as healthcare needs in old age.

- Health insurance premiums

- MediShield Life, ElderShield and CareShield Life premiums are fully payable from your MediSave.

- MediSave may also be used to pay for Integrated Shield Plans (IPs) and ElderShield Supplements, up to withdrawal limits.

Learn more about the benefits and considerations on the use of MediSave here.

You can withdraw up to the respective MediSave Withdrawal Limits for hospitalisation and outpatient treatments. You can check with your hospital or healthcare provider for more details.

Learn more about the MediSave Withdrawal Limits here.

The MediSave/MediShield Life Calculator helps you estimate how much you can withdraw from MediSave and / or claim from MediShield Life. Learn more here.

Under this scheme, you can withdraw up to $200 per year per patient for outpatient medical treatments, if you are aged 60 or older. You may also use your spouse’s MediSave, if your spouse is also aged 60 and above.

The scheme covers treatment received at polyclinics, Specialist Outpatient Clinics (SOCs) and participating CHAS general practitioners (GPs).

Flexi-MediSave may be used in conjunction with other outpatient MediSave schemes, such as MediSave500/700.

It generally covers consultations fees, medical services, drugs and tests necessary for diagnosis or treatment of a medical condition, as ordered by your doctor. However, it does not include dental treatment.

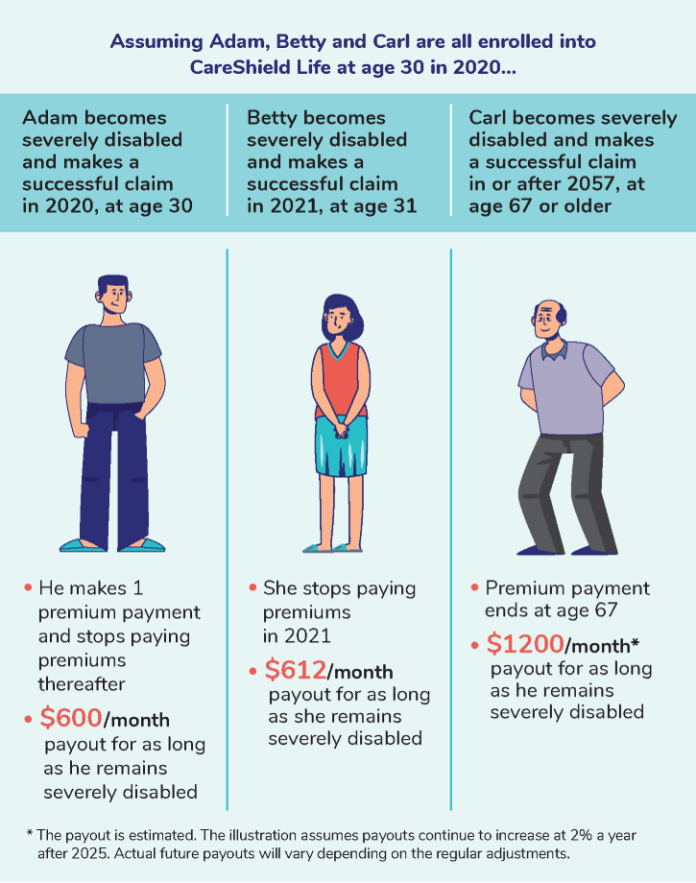

CareShield Life

CareShield Life is a long-term care insurance scheme that provides basic financial support for Singaporeans in the event of severe disability, especially during old age, and the need for personal and medical care for a prolonged duration (i.e. long-term care).

CareShield Life provides you the following in times of severe disability:

- Lifetime coverage

(even after you complete your premium payment at age 67 or for 10 years after joining the scheme, whichever is later) - Lifelong cash payouts for as long as you have severe disability.

- Increasing payouts over time: from 2020 to 2025, the payouts increase at 2% per year, and thereafter be subject to the independent CareShield Life Council’s review

- Worldwide coverage: You will remain covered, be able to make a claim regardless of where you are residing, and receive payouts.

See illustration example below:

If you are...

- Born in 1980 or later

You will be automatically covered by CareShield Life on 1 October 2020 or when you turn 30, whichever is later, regardless of pre-existing medical conditions and disability. There is no need to apply for CareShield Life.

If you are...

- Born in 1979 or earlier

Your participation in CareShield Life is optional^. If you wish to join CareShield Life, you may access the Application to join CareShield Life e-Service with your Singpass.

You’ll be automatically enrolled into CareShield Life if you’re:

- Born between 1970 and 1979

- Insured under ElderShield 400, and

- Did not have severe disability

No action is required if you wish to join CareShield Life. You will receive a CareShield Life welcome package which provides more information on your CareShield Life coverage and personalised premiums. If you don’t wish to remain on CareShield Life, you can choose to opt out by accessing the Opt-out of CareShield Life e-service and log in using Singpass to complete the application by 31 December 2023.

^Except foreigners who become Singapore Citizens or Permanent Residents from 1 October 2020 onwards, for whom participation is mandatory unless they have severe disability.

For more information, visit careshieldlife.gov.sg.

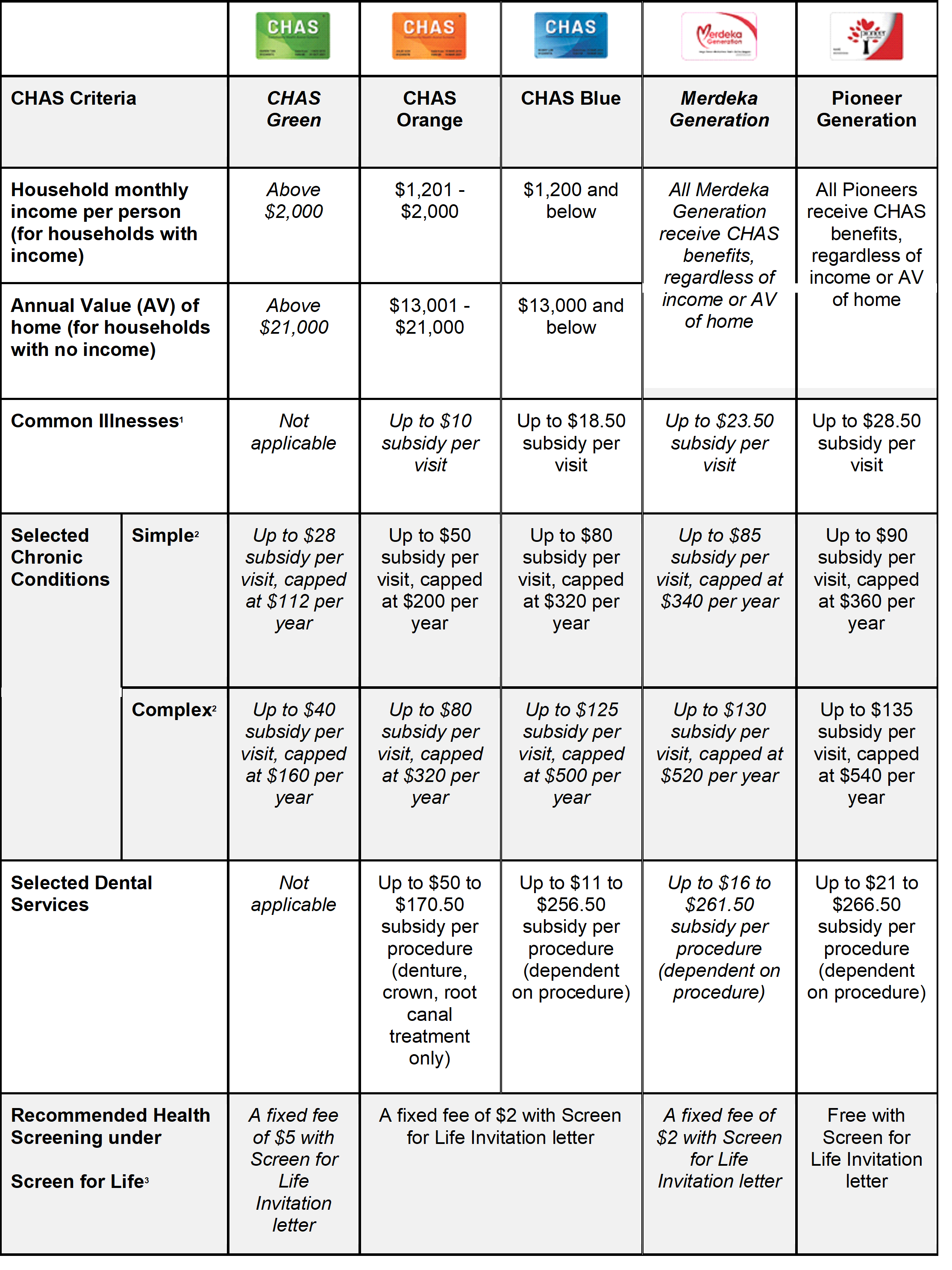

Community Health Assist Scheme (CHAS)

Since 1 Nov 2019, all Singaporean citizens are now eligible to apply for the Community Health Assist Scheme (CHAS).

Apply for your CHAS card for your household here if you have yet to do so.

You can visit any participating CHAS clinic of your choice, using this clinic locator.

To enjoy the subsidies, you need to show your valid CHAS, MG or PG card and NRIC upon registration at clinic.

For those below 15 years old, you will have to present a valid CHAS card with your student ID or birth certificate.

You may log in to MyCHAS using your Singpass to check your subsidy claim balance for the year. Alternatively, you may call the CHAS hotline at 1800-275-2427.

How You Can Make Sure You Have Enough for Medical Expenses

As a Self-Employed Person (SEP)

All Self-Employed Persons (SEPs) who are Singapore Citizens or Permanent Residents and earn an annual Net Trade Income (NTI) of more than $6,000 need to contribute to MediSave.

NTI is your gross trade income minus all allowable business expenses, capital allowances and trade losses as determined by the Inland Revenue Authority of Singapore (IRAS).

Your MediSave contribution depends on your age and annual NTI. Use the Self-Employed MediSave Contribution Calculator to calculate the amount of MediSave to contribute, or refer to the MediSave contribution rates for Self-Employed Persons.

When you contribute to MediSave, you enjoy:

- Up to 6% interest per annum on your MediSave savings

- Savings in your MediSave Account earn 4% interest per annum, and the first $60,000 of your combined CPF balances earns an additional 1% interest per annum. CPF Members aged 55 and above also enjoy an additional 1% interest per annum on the first $30,000 of their combined CPF balance from 1 January 2016.

- Tax relief of up to 37% of your annual NTI, or the CPF Annual Limit of $37,740, whichever is lower

- Using your MediSave savings for:

- Healthcare expenses for you and your family

- Premium payment for MediShield Life (a medical insurance scheme for serious or prolonged illnesses), or MediSave-approved private Integrated Shield Plans

You may also be eligible for Workfare Income Supplement (WIS) payouts of up to $2,667 annually.

You can check the amount of MediSave contributions you need to make, by logging in to the Self-employment dashboard via CPF website using your Singpass.

You can apply for your Singpass online if you do not have one.

There are several ways you can contribute to your MediSave account. The most convenient way is via GIRO, which allows automatic monthly deductions from your bank account.

The payment options are:

Payment mode |

Details |

|---|---|

GIRO: |

Using my cpf digital services (for OCBC/DBS/POSB bank account):

Mail (for other banks):

|

PayNow QR: |

Request for an instalment plan or pay your MediSave payable in full via the Manage your MediSave payable form. |

NETS/ CashCard: |

Pay by NETS or CashCard at any SingPost branches |

You may view your MediSave contributions on the Self-employment dashboard. To access my cpf Digital Services - Self-employment dashboard, please log in to the CPF website using your Singpass.

To claim this relief, there are a few conditions to meet (as stated below).

- Your CPF contributions to your Medisave Account (both mandatory and voluntary) in the previous year were less than $5,000

- You have paid the premiums for your life insurance policy in the previous year

Life insurance relief cannot be claimed on premiums paid for the following:

- Accident or health insurance that covers the sum assured for the death of a person

- ElderShield, CareShield Life or Integrated Shield Plans

You can use this calculator to check your eligibility.

As a Caregiver to Your Family and Loved Ones

You can top up your family members’ MediSave Account using your CPF savings or cash. You get to also reduce your tax bill.

You can also top up your MediSave up to the Basic Healthcare Sum

You can use this for future medical expenses and health insurance premiums.

Use this self-assessment tool to check for the grants and subsidies you could be eligible for, as a caregiver to your family. Some of the grants include:

- Caregivers Training Grant (CTG) to learn how to help your loved ones better in daily care.

- Medical Fee Exemption Card if you have a loved one staying in nursing homes

- Home Caregiving Grant to support your loved ones with at least permanent moderate disability

You may also be interested in:

This page will be updated as additional schemes and measures are introduced.

Please contact the respective government agencies if you have any questions about the listings on this page.

Last updated: 29 May 2024

Give us your feedback

Share with us your suggestions with us here.